Master Budget Prioritization That Actually Works

Stop wrestling with conflicting financial goals. Learn the systematic approach that helps you allocate resources with confidence and clarity.

Stop wrestling with conflicting financial goals. Learn the systematic approach that helps you allocate resources with confidence and clarity.

Most people struggle with budget prioritization because they're using outdated methods. Here's how our systematic approach differs from conventional wisdom.

| Challenge | Traditional Approach | lyseraquint Method |

|---|---|---|

| Conflicting Priorities | Endless debates and guilt | Clear scoring framework |

| Emergency Planning | Vague "what if" scenarios | Structured contingency mapping |

| Income Changes | Start budgeting from scratch | Adaptive priority tiers |

| Long-term Goals | Often sacrificed for immediate needs | Protected allocation system |

| Family Coordination | Arguments and misalignment | Transparent decision matrix |

Over eight comprehensive modules, you'll build a personalized system that transforms budget chaos into clear, defensible decisions. Each week builds on the previous, creating lasting change.

Identify your true financial values and translate them into measurable criteria. This isn't about generic advice—it's about understanding what actually matters to your specific situation.

Learn the mathematical framework that takes emotion out of financial decisions. You'll create a custom scoring model that works for your income level and family structure.

Design adaptive budget categories that automatically adjust when life changes. No more starting over when income fluctuates or unexpected expenses arise.

Safeguard long-term objectives while handling immediate pressures. You'll learn techniques that successful investors use to maintain discipline during uncertainty.

Transform budget discussions from arguments into collaborative planning sessions. Includes scripts and frameworks for productive money conversations.

Our systematic approach to budget prioritization has earned recognition from financial planning professionals and educational institutions across Australia.

Continuing education credits approved for FPA members. Our framework aligns with professional planning standards.

Recommended resource for client education programs. Helps accountants explain budgeting concepts to their clients.

Featured methodology in government financial literacy resources. Meets consumer education guidelines.

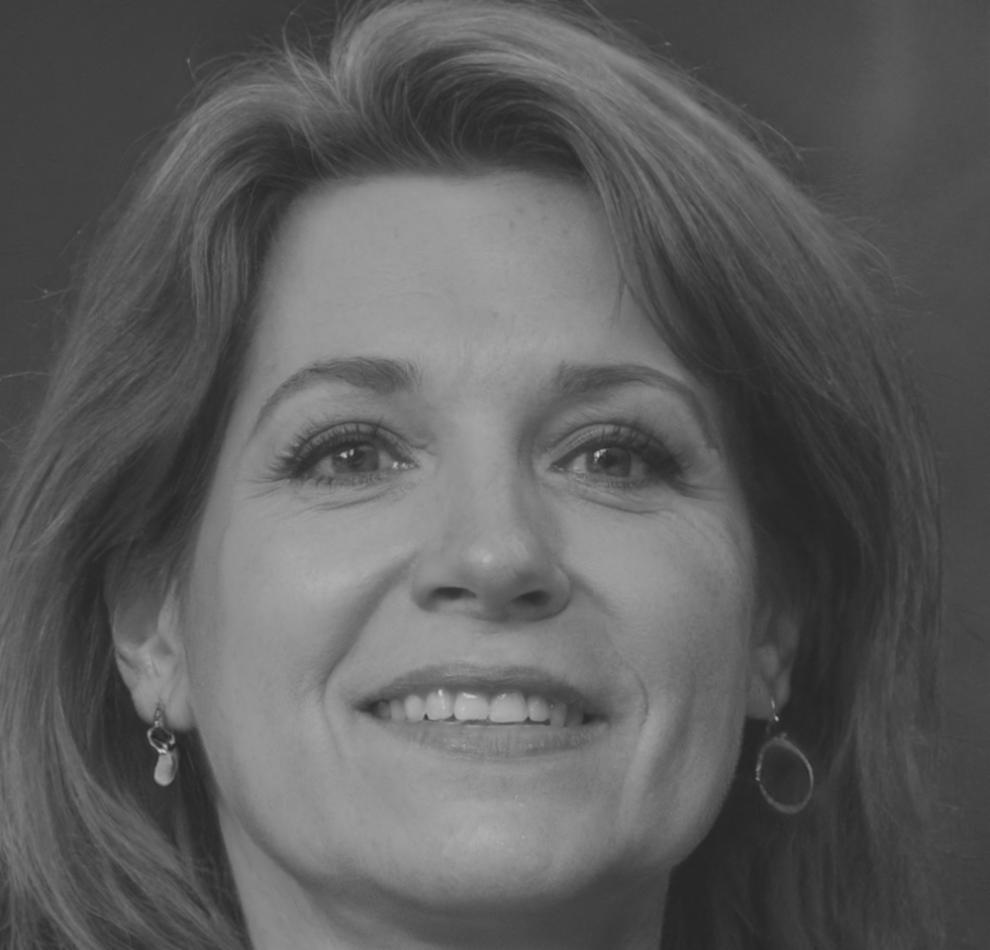

The scoring system completely changed how my husband and I make money decisions. We went from constant stress about competing priorities to having clear criteria we both trust.

Miranda completed our program in August 2024 while managing a growing family and fluctuating freelance income alongside her corporate role. She now runs budget workshops for her company's employee wellness program.

Join our next cohort beginning September 2025. Limited to 25 students for personalized attention and peer learning opportunities.